Condo Insurance in and around Albany

Here's why you need condo unitowners insurance

Cover your home, wisely

- East Bay

- El Cerrito

- Berkeley

- Kensington

- Emeryville

- Richmond

- San Pablo

- Oakland

- San Francisco

- Santa Clarita

- San Luis Obispo

- California

- Arizona

- Nevada

- Oregon

Welcome Home, Condo Owners

As with any home, it's a good plan to make sure you have coverage for your condo. State Farm's Condo Unitowners Insurance has terrific coverage options to fit your needs.

Here's why you need condo unitowners insurance

Cover your home, wisely

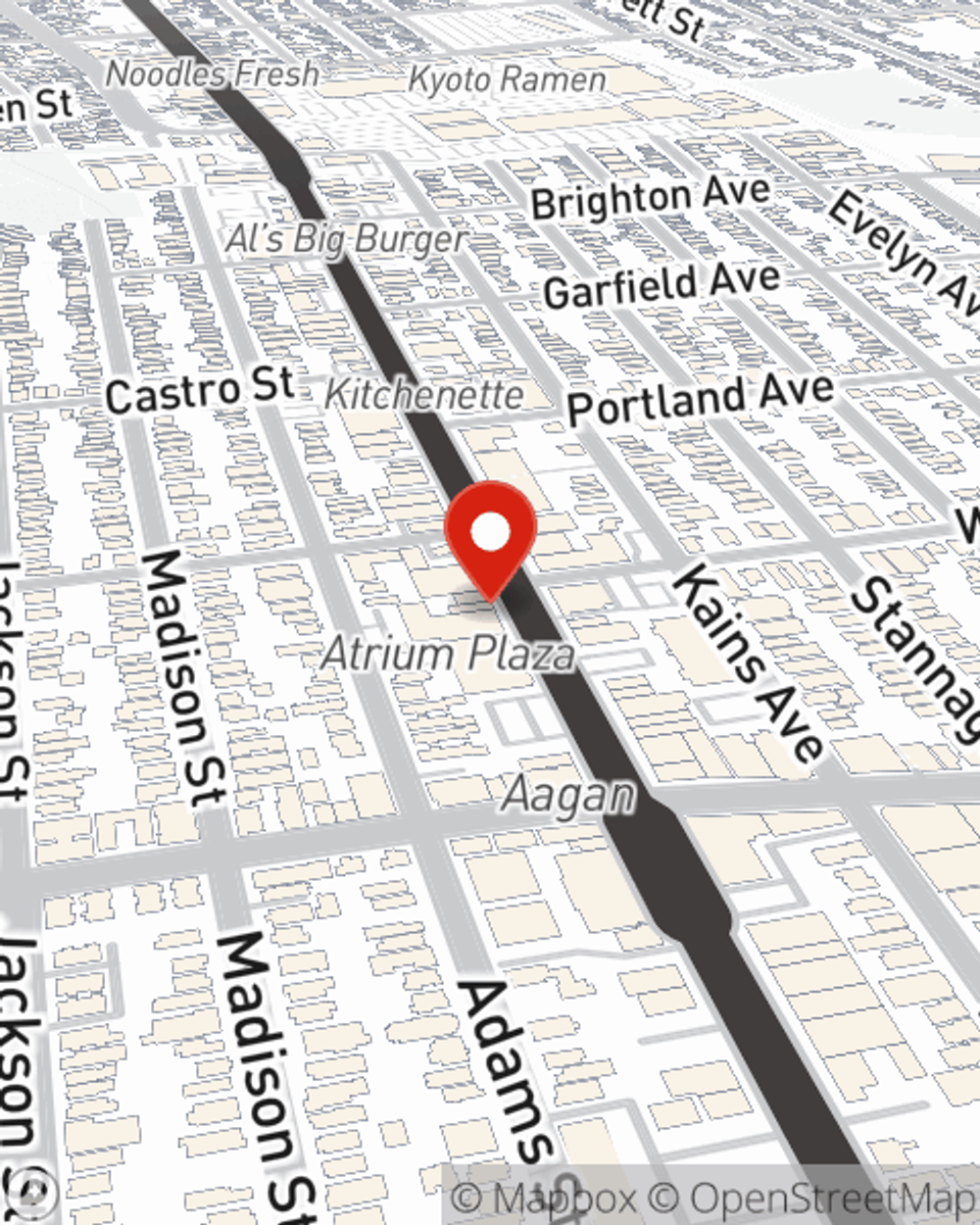

Agent Jay Scott, At Your Service

Your home is more than just a roof over your head. It's a refuge for you and your loved ones, full of your personal possessions with both sentimental and monetary value. It’s all the memories attached to every room. Doing what you can to help keep it safe just makes sense! That's why one of the most sensible steps is getting a Condominium Unitowners policy from State Farm. This protection helps cover numerous home-related problems. For example, what if a fallen tree smashes your garage or lightning strikes your unit? Despite the emotional turmoil or disruption from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Jay Scott who can help you file a claim to help assist paying for your lost items. Preparing doesn’t stop troubles from knocking at your door. Coverage from State Farm can help get your condo back to its sweet spot.

If you're ready to bundle or explore more about State Farm's excellent condo insurance, contact agent Jay Scott today!

Have More Questions About Condo Unitowners Insurance?

Call Jay at (510) 528-6333 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.